The three founding shareholders call for a complete renewal of the Board of Director

Dominique Costantini, Emile Loria and Alexis Peyroles, founding shareholders of OSE Immunotherapeutics (OSE) and former executives from 2012 to 2024, are presenting their resolutions for the General Meeting of September 30, 2025, which will be decisive for the company’s future. They are calling on OSE shareholders to vote in favor of appointing six new directors and dismissing seven directors, including Nicolas Poirier, Chief Executive Officer and Chief Scientific Officer.

The three acting-in-concert shareholders are also calling for votes against the renewal of expiring mandates – which notably concerns Didier Hoch, Chairman of the Board of Directors

They have updated their May 28, 2025 declaration of intent with the French Financial Markets Authority (AMF).

They will state their positions on OSE’s own resolutions once a finalized version has been published.

If these resolutions are adopted at the September 30 General Meeting, OSE’s Board of Directors will be composed as follows:

- Five independent directors, whose expertise and value are recognized by the acting-in-concert shareholders: Pascale Briand, Markus Cappel, Jonathan Cool, Marc Le Bozec and Shihong Nicolaou

- One employee-shareholder representative: Caroline Mary

- One representative of the acting-in-concert shareholders: Alexis Peyroles.

The biographies of these five independent directors, as well as that of Alexis Peyroles, are available on the acting-in-concert shareholders’ website: ose-immuno-ensemble.com.

This new seven-member Board of Directors will bring together directors with highly complementary track records and experience in biotech, the pharmaceutical industry, finance, partnerships and licensing, as well as entrepreneurship.

Dominique Costantini, Emile Loria and Alexis Peyroles have already received three formal notices seeking to silence their website. In view of an escalating and increasingly litigious dispute, they have, on the advice of their lawyers, revised the proposal contained in their Open Letter of September 1, which included “two independent directors chosen from the current Board.” They have decided instead to propose a complete renewal of OSE’s Board of Directors in order to guard against the risk of nullification actions.

All companies listed on a regulated market are in fact required to ensure minimum representation of both genders on their Boards of Directors. Failure to comply with this obligation may result in the nullification of appointments approved at the General Meeting.

In addition, any proposal to appoint a director must have obtained the prior consent of the proposed candidate, who must agree in advance to the functions that may be entrusted to them. Given these requirements, leaving the choice of two candidates to the current Board would have exposed the acting-in-concert shareholders to the risk of non-compliance with gender-parity obligations or to the risk of a refusal from a proposed director candidate—at a time when they would no longer have been able to submit new resolutions.

The timetable is indeed less favorable for the acting-in-concert shareholders, who must publish their resolutions by September 5, than for the Board of Directors, which has until September 15 to publish its complete and final list. As of today, both OSE’s communications and its August 25 convening notice remain particularly vague and incomplete on the subject of director nominations.

Ahead of the September 8 hearing on the legal proceedings brought against them with the aim of “neutralizing or limiting [their] voting rights” (OSE press release of August 29), the acting-in-concert shareholders also express the hope that the Nantes Commercial Court will uphold shareholder democracy by examining the facts on the basis of the law governing acting in concert and its sole purpose—without being distracted by smokescreens, false statements, and conspiracy theories propagated by OSE’s Board of Directors.

They further hope that the General Meeting will not once again be postponed on the basis of new legal pretexts, since any additional delay would clearly run counter to the interests of all OSE stakeholders—except for the Chairman of the Board and the Chief Executive Officer.

OSE patients awaiting therapeutic innovations, OSE employees, and OSE’s industrial partners deserve better than such delays, uncertainties, and risks. Likewise, OSE shareholders deserve better than the fait accompli of dilution.

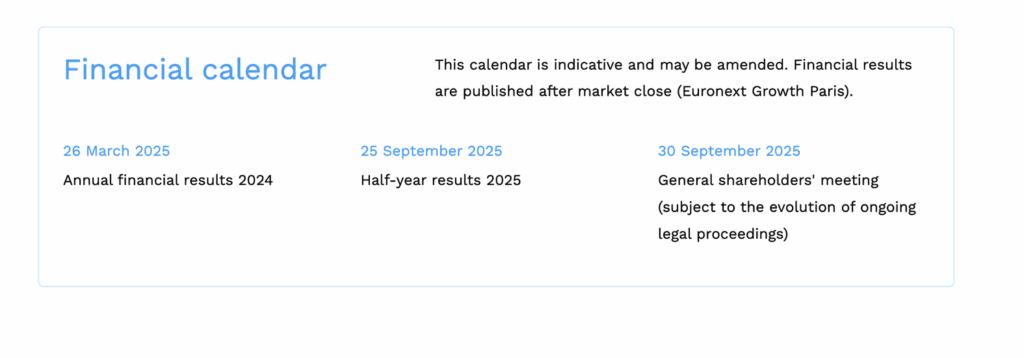

In this regard, Dominique Costantini, Emile Loria and Alexis Peyroles can only express their concern at reading OSE’s website, where such a postponement is explicitly mentioned and could be used as one of the instruments of the strategy pursued by OSE’s Chairman of the Board and Chief Executive Officer.

Below is a screenshot of the Investors section of OSE’s website, taken on September 4, 2025 at 8:00 a.m.

English

English Français

Français