How to Vote at the September 30 General Meeting

The General Meeting will be held on September 30, 2025, at 10:00 a.m. (CET), at the Drawing House Hotel, 21 rue Vercingétorix, 75014 Paris.

The convening notice, including the agenda, the proposed resolutions and the terms of participation, was published today in the Bulletin des Annonces Légales Obligatoires (BALO) and is available here.

Founding shareholders invite you to support their resolutions

For the first time, shareholders will be able to vote electronically via the Votaccess platform, and the General Meeting will be broadcast live in accordance with new regulations. Written questions may be submitted in advance, and postal voting or proxy voting is available.

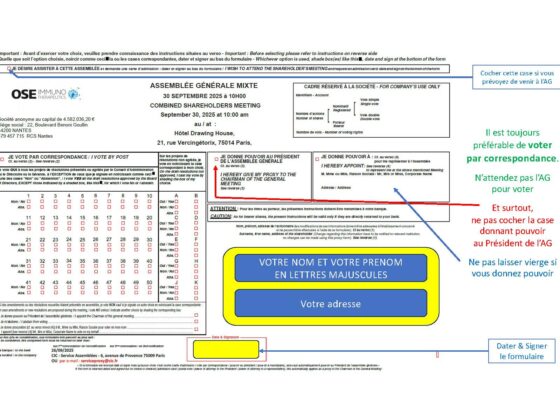

We recommend voting by mail.

This option secures your vote even if you plan to attend the General Meeting in person. It must be sent in advance and is recorded before the Meeting.

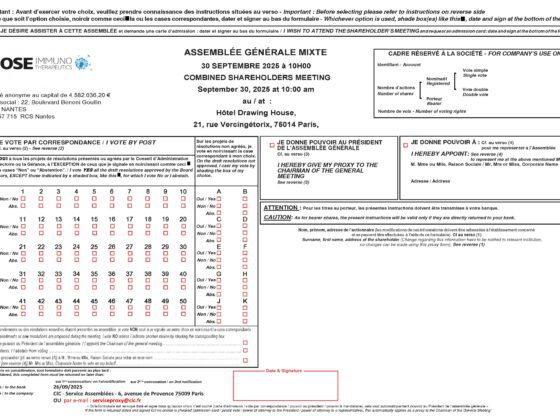

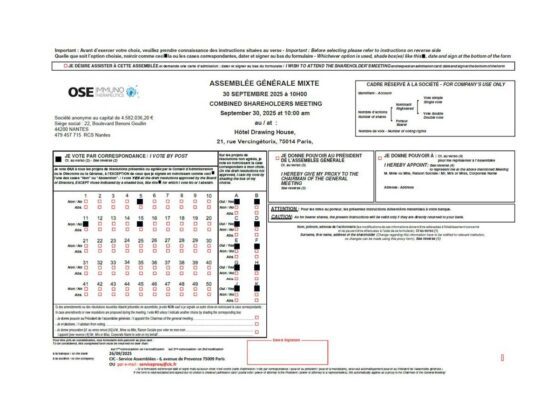

Shareholders may vote by mail or grant proxy.

For this purpose, a single form is made available:

- For registered shareholders: a convening notice including a single form for proxy, postal voting, or a request for an admission card will be automatically sent by post to all registered shareholders.

- For bearer shareholders: you must contact the financial intermediary with whom your shares are registered in order to obtain the single proxy or postal voting form, ensuring that this request reaches the intermediary no later than Wednesday, September 24, 2025, and return it, together with the certificate of participation, to CIC Market Solutions.

→ by email: serviceproxy@cic.fr

or

→ by post: Service Assemblées – 6 Avenue de Provence – 75452 Paris Cedex 09

To validate a postal vote or proxy, the forms must be duly completed and signed and accompanied by the certificate of participation for bearer shares. They must reach CIC Market Solutions no later than Friday, September 26, 2025.

Shareholders may vote online, prior to the General Meeting, via the secure VOTACCESS voting platform accessible as follows:

- for registered shareholders: through the dedicated voting website https://www.actionnaire.cic-marketsolutions.eu

- for bearer shareholders: through the website of the account-holding financial institution. Only bearer shareholders whose account-holding institution has subscribed to the VOTACCESS system and offers this service for this General Meeting will be able to access it.

The VOTACCESS platform for this General Meeting will open on Friday, September 12, 2025, and online voting will close on Monday, September 29, 2025 at 3:00 p.m. (Paris time).

ATTENTION:

Unsigned voting forms will not be counted.

Do not grant proxy in our names (Emile Loria, Dominique Costantini, Alexis Peyroles).

Do not leave blank the name of the proxyholder to whom you may grant authorization.

Do not tick the box “I hereby appoint the Chairman of the General Meeting as my proxy.

All updates are available on the company’s website: https://www.ose-immuno.com/assemblees-generales/

Conditions for remote participation in the General Meeting

A registration link to follow the live broadcast of the General Meeting of September 30, 2025, at 10:00 a.m. will be available on the day of the Meeting on the company’s website www.ose-immuno.com, under the section Investors / General Meetings / 2025 Shareholders’ General Meeting.

Shareholders wishing to connect remotely to follow the General Meeting must make a request by email to the following address: ag2025@ose-immuno.com, providing:

- A certificate of shareholding as of September 26, 2025

- A copy of their identity document

- The telephone number or email address they wish to use to connect

It will not be possible to vote remotely.

To ensure shareholders are fully informed, we also reproduce here Article 30 (‘Participation in General Meetings – Voting’) of our company’s Articles of Association.

“Any shareholder may take part in general meetings—of whatever nature—either in person, by proxy, or by correspondence.

Proof of the right to participate in general meetings is provided:

- for registered shares, by their registration in the company’s registered share accounts no later than zero hour, Paris time, on the second business day preceding the meeting;

- for bearer shares, by their recording in bearer share accounts held by the authorized intermediary, no later than zero hour, Paris time, on the second business day preceding the meeting.

The registration or accounting entry of securities in bearer share accounts held by the authorized intermediary is evidenced by a certificate of participation issued by that intermediary.

However, the Board of Directors may shorten or waive these deadlines, provided that it applies equally to all shareholders.

Shareholders who have not paid up the amounts due on their shares are not entitled to attend the meeting.

The meeting may only deliberate on items included on the agenda. However, it may, in all circumstances, dismiss one or more directors and appoint replacements.

One or more shareholders representing the portion of capital required by law may, in accordance with legal procedures and deadlines, request the inclusion on the agenda of draft resolutions.

In the case of postal voting, only voting forms received by the company three days prior to the date of the meeting will be counted.

In the case of remote voting by electronic ballot, or proxy voting by electronic signature, voting shall take place under the conditions set out in applicable regulations.

Any shareholder may also participate in general meetings by videoconference or by any means of telecommunication permitted by law and regulations, as specified in the meeting notice.

An attendance sheet containing the information required by law shall be prepared for each meeting.”

Together, let’s ensure OSE’s success

We are a Trio, but we see that many share our perspective.

We are calling for the dismissal of the current Board members because it is in the interest of:

- all shareholders,

- employees caught in the middle of this conflict,

- industrial, scientific, and institutional partners who place their trust in OSE,

- patients awaiting innovative therapeutic solutions.

Together, we will ensure the success of OSE, it’s Nantes center and its Paris team.

We are fully aware that the current situation is uncomfortable for OSE’s employees and partners, who now find themselves caught between two groups of shareholders they know well, have worked with, and with whom they have personal relationships.

We regret this situation, which would have lasted only a few weeks had the Board of Directors not postponed the General Meeting from its original date of June 25 to September 30.

We know OSE’s employees well. Many of them were recruited between 2012 and 2022, when we were leading OSE, and until June 2024, when Dominique Costantini chaired the Board of Directors. We know their value, and we are proud of their work.

We therefore wish to reassure employees in light of the false intentions attributed to us:

OSE is a Nantes-based company, and, under our leadership, OSE will remain a Nantes-based company.

English

English Français

Français